Oil Heat vs. Natural Gas Heat

There are many misconceptions out there about oil heat I’d like to clear up because it does get a bad rap from a lot of the mis-information flying around is contagious and seems to be coming from the Natural Gas companies and the wannabe conservationist who really aren’t as educated about the matter as they’d have you believe.

I’d just like to say first that there are pluses and minuses for each type of heating fuel system and overall found that taking all points into consideration oil vs gas get an equal grade from me.

NEWER oil furnaces are as clean burning and as efficient as natural gas furnaces. If you notice any "Soot", whether it be from an oil burner or a gas burner, it is an indication of a possibly cracked "Heat Exchanger".

Don't let anyone try to convince you that all oil furnaces are "Dirty". It's just not true. Sometimes there can be an odor of the fuel oil itself, but that usually occurs when filling of the oil tank takes place.

As far as prices go, oil and gas can both fluctuate and certainly have been trending up.

heating oil is almost the same as #2 diesel fuel that trucks use, except heating oil has none of those additives or detergents that diesel has.

If the oil tank is located outside, than you will need to use #1 heating oil. It has an additive in it so that it does not "Gel" up in cold weather. And radiant heat (the old radiators) are indeed a most pleasant, even heat. Much nicer than "Forced Air" systems which tend to have temperature swings however that is another topic, there are Forced Air oil heated systems available.

- Oil heat burns hotter

- Oil heat is Safer than Gas which is explosive!

- Oil lasts longer and is generally cheaper than natural gas

- Better local service from Oil company over Gas unless there is an emergency gas leak!

- Oil company’s offer service contracts to maintain your equipment just like gas companies.

- Oil heat can be used in locations where gas lines have not been or ever will be routed.

- Oil is versatile and you can have a Forced Air oil heating system just like gas.

- Oil heat systems are not more expensive to maintain when serviced regularly and properly, this can be done with an inexpensive service contract.

The Oil Heat Advantage

Oil heat has always provided efficient and affordable warmth, but it’s gotten even better in recent years. Here are some surprising facts about the “new” oil heat.

Oil heat is highly efficient

- Many oil heat systems now display the prestigious Energy Star label, which signifies that they are technologically advanced and clean burning. Some oil heat systems have efficiency ratings that exceed 90%.

- Compared to 25 years ago, homeowners now need an average of 500 fewer gallons of oil to heat their homes each year.

- Oil heated homes heat up quickly and provide even and efficient heat. For every gallon of oil burned, a whopping 140,000 Btu's are produced. That's 40% more Btu's of heat than an equivalent amount of natural gas produces.

Oil heat is environmentally friendly

- Particulate emissions have been reduced significantly and new oil heat systems now burn fuel 95% cleaner than 25 years ago. Average soot emissions for properly adjusted flame retention burners are less than .003 pounds for every 7 gallons of oil burned. This works out to about 6 ounces of soot per year (approximately equal to natural gas burners).

- The industry is moving toward the wider use of fuels that will burn even cleaner than conventional heating oil. Test studies have already shown that BioHeat®, a blending of conventional fuel with biological products like soybeans, have reduced equipment service costs for oil heat users.

Oil heat remains a good value

- Heating oil prices, when adjusted for inflation, actually dropped 23% during the 1980s and 1990s. More recently, the price of heating oil has increased—but so has the cost of natural gas and all other heating fuels.

Oil heat is versatile

- Oil-fired water heaters provide virtually unlimited hot water at low cost. Not only does an oil-fired water heater save huge amounts of money over its lifetime, it is also perfect for homes with high hot water demand (growing families, homes with hot tubs, etc.).

Oil heat is safe

- Heating oil cannot explode. If you dropped a lit match into a barrel of oil, the match would go out as if you dropped it in water. Oil must first be turned into a fine particle mist before it will ignite and burn, typically at a temperature of 130-140 degrees.

- Oil heat poses an extraordinarily low risk for carbon monoxide poisoning.

Oil heat gives you service choices

Oil heat companies aren’t large monopolies, so homeowners can choose a company that best suits their needs and personalities. Most oil dealers are locally owned and operated with deep roots in their communities.

What about old oil heat systems?

Most homeowners have the attitude that if their heating system works, it doesn't need replacing. The trouble with that logic is that many heating systems still in use are 40 years old or older! The efficiency of a system that old is so low that the owner is probably using, and paying for, twice as much oil as he or she would need with a modern oil heat system. With today's heating oil prices, that's a tremendous waste of money.

Save clients money!

According to the nonprofit Consumer Energy Council of America, the best way to cut heating costs is to improve system efficiency. This means real estate agents who encourage clients to switch away from oil could be wasting thousands of dollars of their clients' money due to conversion costs. But if clients stay with oil heat, they don't have to pay those conversion costs. Plus, with a modern oil heat system, it can cost up to 40% less to heat a home than with a system made only 30 years ago!

Peace of mind

Explain to your clients that replacing an old clunker of a heating system will save them stress for several reasons:

- New systems are less likely to break down.

- Most new systems come with extended warranties.

- Modern heating systems can vastly improve the comfort throughout the home.

- Today's super-efficient systems provide more heat from less fuel.

If you have clients who are thinking about switching away from oilheat, give them the PRO$ "Homeowner's Guide to Heating with Oil" (see FREE materials page) and encourage them to talk with several local oil dealers first. It could save them thousands of dollars and earn you valuable referrals!

© 2009 Warm Thoughts Communications, Inc.

Grant Money Available for Replacing Oil Tanks Even Without Leaks

NJ Grant Program for Underground Tank Replacement has been increased! Qualified homeowners can now get from $3,500+ to upgrade their underground oil tank. Qualifications are liberal.

The Petroleum Underground Storage Tank Upgrade Remediation and Closure Fund was first established in 1997, but only applied to tanks that leaked. Money for the fund, administered jointly by the New Jersey Economic Development Authority (NJEDA) and the New Jersey Department of Environmental Protection (NJDEP), comes from corporation taxes levied by the state.

On August 2, 2006, Governor Corzine signed legislation that enacted important changes to the fund. The change gives a homeowner the power to be proactive. You can now apply for a grant to upgrade a tank BEFORE it leaks.

Heating Oil Storage Tank Issues

Modern heating oil storage tanks are marvels of contemporary engineering. They have leak-proof inner walls of plastic or fiberglass and an outer wall of corrosion-resistant metal (for aboveground models) or a plastic/fiberglass outer wall (for underground models).

There are presently no federal or state laws regulating active underground tanks. However, if your clients are replacing a tank, make sure they check with their municipality for local replacement regulations and options.

Older underground tanks

For many years, home builders installed bare metal tanks for underground heating oil storage. Unfortunately, because metal corrodes, those tanks occasionally leak. Some tanks last 50 years or more, while others need to be replaced after 20. There is no set rule for metal tank longevity because so much depends upon how they were installed, the surrounding soil, water tables and salinity.

We recommend that every homeowner replace metal underground tanks with new, leak-proof plastic or fiberglass models. Encourage your clients to contact local oil dealers for estimates or recommendations on tank replacement options.

When selling a home, a new oil storage tank can make a huge difference in how quickly the home sells. It can also have a positive impact on the price.

Replacement options

If your current tank needs to be replaced, you have two good options.

1. Replace an old underground tank with a modern, corrosion-resistant underground tank. With today's technology, a new tank can be isolated from the ground, making it worry free.

2. Replace an underground tank with an aboveground tank. Aboveground tanks are normally smaller (275 gallons) and they can be customized for hard-to-fit places indoors. They can also be installed outside the home and hidden in a tank enclosure.

Many homeowners now have aboveground tanks installed inside tank enclosures, such as the one pictured here.

Guidelines for replacement

If a homeowner decides to replace an underground tank with an aboveground tank, the buried tank must either be removed or properly closed and abandoned. To close the tank, it needs to be emptied, cleaned and then filled with an inert material such as sand or foam.

It is important to work with a licensed experienced professional when closing and abandoning an underground tank.

Before proceeding with a tank abandonment, homeowners should contact their municipal governments or local oil companies to find out about any codes or regulations that may affect the removal or abandonment of an underground tank.

How to tell if an oil tank

has been closed properly

The best resource is your town building inspector's office, which will have a record of the tank abandonment on file. Additionally, if a tank has been legally and properly abandoned, there will be no vent or fill pipe.

Underground tank testing

Frequently, a home buyer or seller is faced with a requirement from a lender or insurance company to have an underground oil tank tested. If this happens, here are two things to keep in mind.

- There are several tests that can be conducted on an underground tank, and the need for one test or another can vary. Often, a combination of tests is appropriate. To avoid confusion and to get a reliable assessment of which tests are best for your situation, consult a local oil heat dealer.

- Any testing on an underground tank should be conducted by a company that is certified to do tank testing.

Aboveground tank inspection

Here are some things to check when listing or selling a home with oil heat:

- Make sure the oil tank's fill pipe and vent pipe are metal, not plastic, and that they have caps.

- Look for leakage from and around tank fittings, valves, filters or the tank's gauge.

- Make sure the tank legs are in good condition and that the tank belly doesn't touch the ground.

- Look for signs of corrosion.

For more information about oil tank options, call your local oil heat dealer.

© 2009 Warm Thoughts Communications, Inc.

Understanding Heating Oil Prices

Oil prices have been in the news lately — and the news has been good. Recently, crude oil prices dropped to their lowest point in five years. As a result, oilheat dealers have been able to lower their heating oil price back down to a normal level. This will make marketing an oil-heated home much easier for you.

A great value

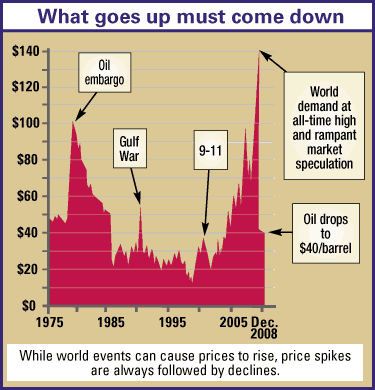

Historically, heating oil prices have delivered great value for homeowners. And while energy prices rose in the first half of 2008, as expected, the spike was followed by steep declines. So oilheat consumers can rest assured that heating oil at $4 a gallon is the exception and not the rule. So what causes price spikes? A number of factors affect oil prices — economic conditions, world energy supplies, unchecked market speculation, global events and the weather, to name a few. The chart shows how those factors have affected oil prices in the past.

What does the future hold?

The best news of all is the future of oil prices. According to the U.S. Department of Energy's Short-Term Energy Outlook, crude oil prices are expected to hold at normal levels, around $50 a barrel. This means that oilheat will continue to be a great value to homeowners. And no matter where oil prices are headed, the commitment of oilheat dealers to their valued customers will never waver.

When your clients have questions for you about oil pricing, here are some things to remember:

Local heating oil dealers don't control prices. In fact, many dealers have programs specifically designed to help their customers control costs and even out their fuel payments. Energy prices tend to track one another. That's why the Consumer Energy Council of America says, "It makes no economic sense to switch heating fuels." Thanks primarily to the U.S., Canada and Mexico, about three-quarters of the heating oil used in the United States comes from outside the Persian Gulf. This means our energy costs are much less dependent on the Middle East than people think.

© 2009 Warm Thoughts Communications, Inc.

Additional Information Resources:

- FAQ about the Grant http://www.newtanksnj.org/faqs.aspx

- American Council for an Energy Efficient Economy http://www.aceee.org/consumerguide/heating.htm

- Oil Heat America http://www.oilheatamerica.com/

- Fuel Merchants Association of America http://www.fmanj.org/

- Fuel Merchants Association of New Jersey http://www.newtanksnj.org

Link for Realtor Education www.nj.oilheatpros.com

Toll-Free Phone: (866) 807-PROS (7767)

NJ companies that replace oil tanks and remediate old tank leaks:

- Meridian Environmental Services (Ed Golub) 732-281-1900 x 102 http://www.meridianenvironmental.com/ ProTank http://www.protankservices.com/ 908-851-0057

1 Rahway River Parkway • Union, NJ 07083 - Mike Hoensch 973.390.5356 http://www.mhtankco.com/

A more comprehensive list of vendors can be found here

Fuel Merchants Association of America http://www.fmanj.org/

![]()

www.MarivicRealty.com

2056A Lincoln Highway

Edison, NJ 08817-3330

Office: 732-650-9911

Toll Free: 1-866-745-4622

Located Across from The Pines Manor & Crowne Plaza Hotel in the Nixon Plaza Shopping Center where the Labonbonniere Bake Shoppe

No matter where in the country or the world you’d like to live, call us and we will either personally assist you or match you up with an experienced agent in your area that would be happy to assist in your search, obtain financing, etc.

Click here for Door to Door Directions

Warning, Not for claustrophobe's!

Warning, Not for claustrophobe's!

raising the minimum credit score requirement

raising the minimum credit score requirement